CDTL Newsletter – April 2023

1. Single Touch Payroll (STP)

STP Phase 2 reporting has now been introduced. STP Phase 2 requires employers to report more information about employees each pay period, through the employers payroll software (such as Xero or MYOB). Most Digital Service Providers (DSP) are now ready for STP Phase 2 reporting. If you require assistance to prepare for STP Phase 2, please contact our office.

How does STP work?

STP works by sending tax and super information from your STP-enabled payroll or accounting solution to the ATO each time the employer runs their payroll. As mentioned above, STP Phase 2 will send more information to the ATO, such as:

- details of the remuneration you pay to an employee

- the type of income for the employee (such as salary and wages, or working holiday maker income)

- the components which make up the amounts (such as gross pay, paid leave, allowances or overtime)

- details of the employees PAYG withholding, such as:

- the amounts you have withheld from payments made

- information about how you calculated the amount, which you currently provide to us by sending a copy of the employee’s TFN declaration

- super liability information.

If you have made an error in a pay run (after submitting it via STP), you can make corrections to your employees’ YTD amounts in your next pay event in the same financial year, or through an update event.

2. Personal Services Income (PSI)

COVID has changed our perceptions on work particularly how we want to work and where we want to work from. There has been a trend of leaving the big city, either moving to regional or smaller town or setting up small businesses, to provide us with a more fulfilling work/life balance, which probably involved leaving long term employment, to set up your own business and become a contractor rather than an employee.

Contractors commonly get paid (rewarded) for their personal efforts or skills, such as an IT consultant, project manager, construction worker, medical practitioner etc. This type of income is known as Personal Services Income (PSI).

What is PSI?

PSI rules were introduced to help keep a level playing field among individuals. The rules are designed to prevent individuals diverting or splitting the income with other individuals or entities in an attempt to pay less tax. An individual can receive PSI in almost any industry, trade or profession.

Only individuals can earn PSI income as PSI is mainly a reward for an individual’s personal efforts or skills. However, individuals can earn PSI either directly as a sole trader, or through another entity such as a company, partnership or trust. When an individual earns PSI indirectly through another entity, that entity is referred to as a ‘personal services entity’ (PSE).

Income is classified as PSI when more than 50% of the income you’ve received from a contract is a reward for your personal efforts or skills, rather than income generated from the use of assets, the sale of goods, or from a business structure.

When working out if your income is PSI, you need to look at the income you have received from each contract as well as the terms of your contract/written agreements that detail the work arrangement as these documents can assist you in working out the proportion of income from the contract that relates to your labour/skill/expertise & efforts, and materials/tools/equipment used. If 50% or less of the income received from a contract was for your personal efforts or skills, then none of the income from that contract is PSI.

If you’re a personal services business (PSB) for a particular income year, then the PSI rules won’t apply for that year. Restrictions around a PSB are not as tight as those for PSI.

What is a PSB?

A personal services business is where more than 50% of the amount you received from a contract was for your labour, skills AND you answer YES to any of the following PSI tests:

- a) Meet the results test for at least 75% of your PSI income, where you are:

- Paid to produce a specific result

- Required to provide the equipment or tools

- Required to have mistakes fixed at your own expense.

- b) Meet one of the other PSB tests and no more than 80% of your income can be earned from one client (or their associate)

- c) The remaining PSB tests, where you must pass at least one, being:

- Unrelated clients test

- Employment test

- Business premises test

If you’re a company, partnership or trust and you have more than one individual generating PSI, the self-assessment rules and PSB tests need to be applied to each individual.

If you can’t self-assess as a PSB, then the PSI rules will apply.

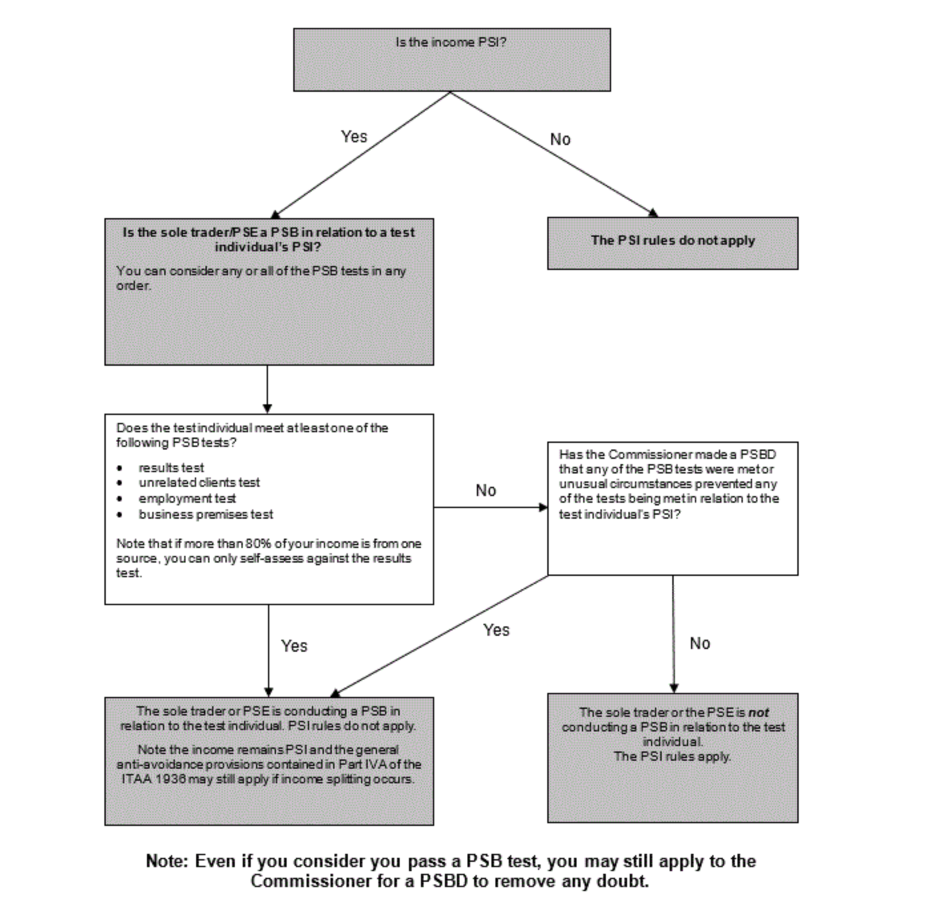

The following flowchart can be used to determine whether PSI rules will apply.

3. Working from home expenses and Home-based businesses

If you operate a home-based business, you may be able to claim the business-use portion of expenses you incur, such as occupancy expenses (eg. rent) and running costs (electricity, gas, cleaning etc) under the new revised fixed-rate method.

The ATO has released Practical Compliance Guideline PCG 2023/1, which sets out its guidance regarding how to calculate a deduction for expenses incurred from 1 July 2022 as a result of working from home.

From 1 July 2022, an individual can either calculate deductions for working from home expenses using the new revised fixed-rate method set out in PCG 2023/1, or use the actual expenses method.

In order to use the revised fixed-rate method, you must satisfy the following three criterias:

- You must be working from home, carrying out employment duties or running a business on or after 1 July 2022; and

- You must have incurred additional running expenses which are deductible under section 8-1 of the ITAA 1997, as a result of working from home; and

- You must keep relevant records in relation to the time spent working from home and additional running expenses that they incurred.

For the 2022–23 income year, the revised fixed rate is 67 cents per hour. The rate includes the additional running expenses a taxpayer incurs for:

- electricity and gas expenses for lighting, heating, cooling and electronic items used while working from home;

- internet expenses;

- mobile and home phone expenses, and;

- stationery and computer consumables.

If you are using the revised fixed rate method, you can’t claim an additional separate deduction for these expenses.

Taxpayers no longer need to a dedicated home office space to rely on the PCG 2023/1.

Where there is more than one taxpayer in the same household working from home, each taxpayer can only rely on the PCG if both taxpayers meet the three eligibility requirements set out above. However, where one taxpayer chooses to calculate their deductions using the actual expenses method, they need to ensure their expenses are appropriately apportioned as between taxpayers.

If you want to use the revised fixed rate method to calculate your deduction, you will need to keep a record of all hours worked from home for the entire income year. If you have not kept a total number of hours worked for the whole year, you can use a representative record of hours from 1 July 2022 to 28 February 2023, but you will need total number of actual hours worked from 1 March 2023 to 30 June 2023. Acceptable methods for recording hours include timesheet, roster or diary.

4. Div 293 Tax

As we approach the May lodgement deadline, majority of taxpayers have now lodged or will soon lodge their 2022 income tax returns. Lodgement of the 2022 tax return may trigger a Division 293 tax assessment from the ATO for some taxpayers.

Division 293 tax is an additional tax on superannuation contributions. This tax applies to individuals when their combined income and contributions are greater than the threshold ($250,000) during a financial year.

The ATO will determine if there is a Division 293 liability once a taxpayer has lodged their tax return, and their superannuation fund (APRA fund or SMSF) has lodged its annual return. If there is a tax liability, the ATO will issue a Div 293 notice.

If you have received a Div 293 notice of assessment, you have two options to pay it:

- Release it from super, or

- Pay it with their own money

If you would like to release it from super, you must make a request for the Commissioner of Taxation to release the money for you. The request is made via an election form, which is a document that you complete and send to the ATO. The election form can also be completed online (in my.gov.au or via the Tax Agent Portal).

Payment of this liability is the responsibility of the individual who received it and it must be paid by the due date on the assessment. Individuals have 60 days to elect to release money from super to pay the Division 293 liability, however this does not change the actual due date for payment.

If you are releasing the funds from your SMSF, please note that the SMSF cannot release any amounts until:

- The member has made an election to release the money from super, and

- Your SMSF has received a release authority from the ATO

Upon receiving the releasing authority, the Trustees of the SMSF will be required to make the payment to the ATO. The ATO will then use this amount to pay the Division 293 liability.

5. Small Business Boosts

On 29 March 2022 (as part of the 2022–23 Budget), the Government announced it will support small business through the following new measures. These measures are not yet law.

Small Business Technology Investment Boost

Subject to law, small businesses (with aggregated annual turnover of less than $50m) will be able to deduct an additional 20% of expenditure incurred for the purposes of business digital operations on business expenses and depreciating assets (eg portable payment devices, cyber security systems, subscriptions to cloud based services). An annual of $100,000 will apply to each qualifying income year.

For expenditure over the cap, businesses can continue to deduct these under existing law. Where expenses are ineligible for the boost, businesses may continue to deduct these under the existing tax law. The ATO will provide further details on eligible expenses once the law has passed.

This measure will apply to expenditure incurred in the period commencing from 7:30 pm AEDT 29 March 2022 until 30 June 2023. It is anticipated that special rules will apply to when the bonus deduction can be claimed in tax returns depending on a business’s balancing date.

Small Business Skills and Training Boost

Also subject to law, small businesses with an aggregated annual turnover of less than $50m will be able to deduct an additional 20% of expenditure that is incurred for the provision of eligible external training courses to their employees by registered providers in Australia.

Where expenses are ineligible for the boost, businesses may continue to deduct these under the existing tax law.

This measure will apply to expenditure incurred in the period commencing from 7:30 pm AEDT 29 March 2022 until 30 June 2024. It is anticipated that special rules will apply to when the bonus deduction can be claimed in tax returns depending on a business’s balancing date.

6. Changes to tax on superannuation balances over $3 million

As you have all read, heard, watched on the news, on 28 February 2023, the Government proposes to increase the concessional tax rate for superannuation balances over $3 million.

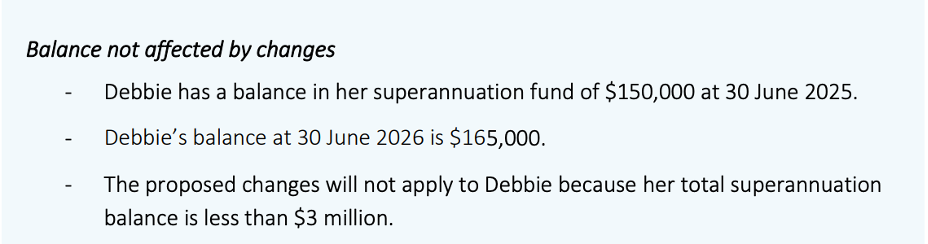

From 1 July 2025, the Government will reduce the tax concessions available to individuals whose total superannuation balances (TSB) exceed $3 million at the end of the financial year. TSB includes all of a member’s super, ie the member’s pension and accumulation accounts.

It is proposed that individuals with TSB over $3 million will pay an additional 15% tax on earnings (including unrealised gains) attributable to the excess of the balance over $3 million – ie these earnings will be generally taxed at 30%.

Note that the proposal is $3 million per person, not $3 million per fund. This means that a couple would still be able to have close to $6 million in their superfund before being impacted by these proposed measures (as long as the total is split evenly between each member and neither member’s balance goes over $3 million).

The $3 million TSB amount won’t be indexed and won’t increase with inflation each year.

There are three essential elements for the proposed new rules:

- There will be a new, special extra tax at 15% on ‘some’ of their superfund earnings

- The tax will be levied on the member personally, not the superfund

- The member will be allowed to take money out of their fund to pay for this new tax.

If a member is liable for this new tax, the member will have the choice of either paying the tax from their own money or from their superannuation funds (much like Div 293 tax). The member will have to meet a condition of release in order to release the funds from super.

The balances in excess of $3 million will be tested for the first time in the 25/26 tax year and the ATO will issue notices of assessment to individuals during the 2026-27 financial year.

The actual rate of tax will be progressive and will be based on the amount that a member’s superannuation balance exceeds the $3 million cap, up to a maximum rate of 15%.

As funds do not currently report (or generally calculate) taxable earnings at an individual member level, the calculation uses an alternative method for identifying taxable earnings for members with balances over $3 million.

Treasury’s paper on “Better Targeted Superannuation Concessions” can be found on the following link:

(https://ministers.treasury.gov.au/sites/ministers.treasury.gov.au/files/2023-03/better-targeted-superannuation-concessions-factsheet_0.pdf).

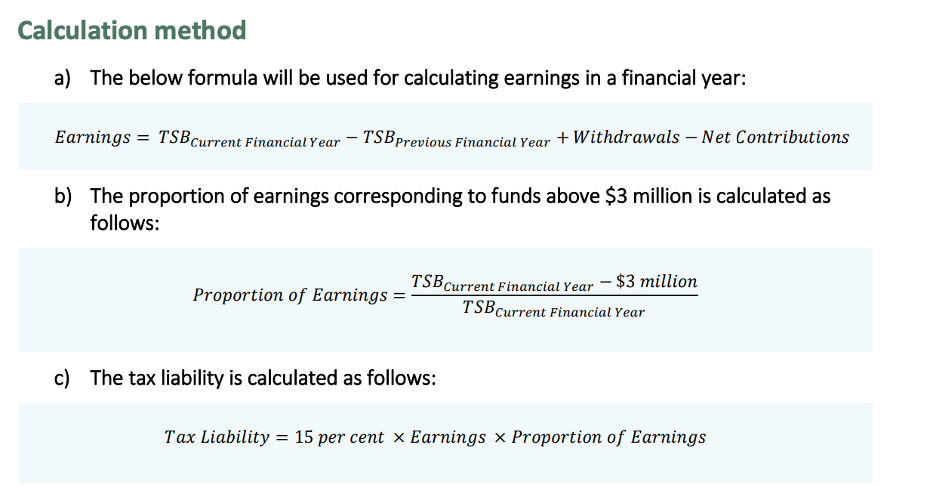

The calculation method, from the Fact Sheet is as follows:

The formula calculates the difference between the member’s TSB for the current and previous financial years and adjusts for net contributions (which excludes contributions tax paid by the fund on behalf of the member) and withdrawals.

The formula for working out the amount of additional tax payable is set out in the Fact Sheet.

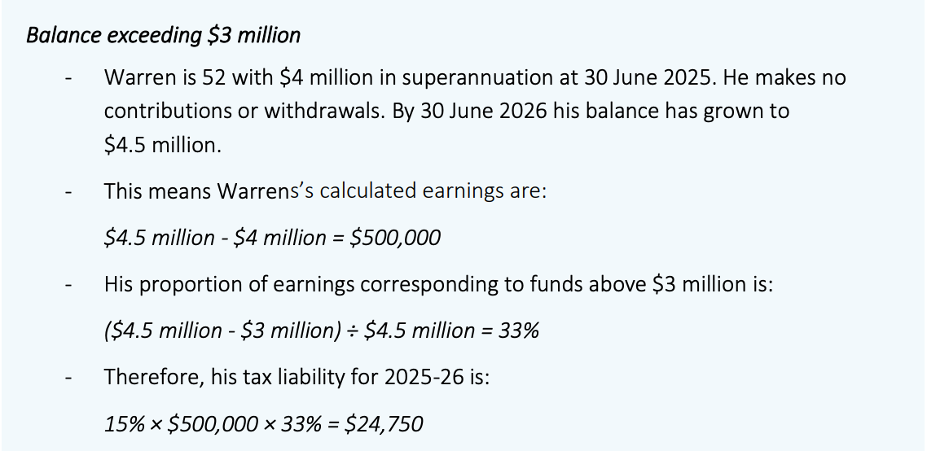

An example from the Fact Sheet is set out below:

Negative earnings can be carried forward to reduce the tax liability in future years. It appears from the example in the Fact Sheet that the loss will be applicable only against future earnings as calculated under the regime, and not against other income.

7. Transfer Balance Cap Indexation

From 1 July 2017, the total amount of super you can transfer into a tax-free retirement account is capped. This is called the transfer balance cap (TBC).

The TBC is a lifetime limit on the total amount of super that can be transferred into tax-free retirement phase income streams, including most pensions and annuities.

The general TBC is reviewed each financial year and indexation occurs in line with the consumer price index (CPI) in $100,000 increments. When TBC was first introduced (with effect from 1 July 2017), the individual’s TBC was $1,600,000.

On 1 July 2021, the general TBC increased to $1.7 million. However, as a result of a substantial increase in the CPI, the TBC is due to increase on 1 July 2023 by $200,000, to $1.9 million.

As such, individuals who start their first retirement phase income stream (otherwise known as a pension) on or after 1 July 2023 will have a TBC of $1.9 million.

From 1 July 2023, individuals will have a TBC between $1.6 million and $1.9 million, depending on the extent to which they have already utilised their personal TBC (if at all).

An individual who already had a transfer balance account and at any time met or exceeded their personal TBC will not be entitled to indexation, and their personal TBC will remain the same.

An individual’s TBC:

- will be equal to the general transfer balance cap that applied when the individual started their first retirement phase income stream, and

- may be increased by proportional indexation depending on the highest ever balance they have held in retirement phase.

For example, an individual who started their first retirement phase income stream (pension account) on 1 January 2022 of $1,700,000 at the time of commencement, would not be entitled to the indexation, as they have fully utilised their TBC of $1,700,000.

If an individual has no cap space or excess transfer balance, they will not be entitled to indexation of their transfer balance cap.

Taxpayers can view their personal transfer balance cap in ATO online services, through myGov.

If you are considering commencing a retirement phase income stream, we recommend that you do so after 1 July 2023 so that you can utilise the full TBC of $1.9 million.

8. Important lodgement due dates

| 21 April 2023 | Lodge and pay Jan-March 23 quarter PAYGI for head companies of consolidated groups |

| 21 April 2023 | Lodge and pay March 2023 monthly BAS |

| 28 April 2023 | Lodge and pay Jan-March 23 quarter BAS |

| 28 April 2023 | Lodge and pay Jan-March 23 quarter IAS |

| 28 April 2023 | Employers to make super guarantee contributions for the Jan-March 23 quarter |

| 15 May 2023 | Lodge 2022 tax returns for all entities that did not have to lodge earlier and are not eligible for 5 June concession |

| 15 May 2023 | Due date for companies and superfunds to pay (if required) |

| 21 May 2023 | Lodge and pay April 2023 monthly business activity statement |

If you wish to discuss any of the above matters, please contact our office.

Should you have any questions, please feel free to contact our office on 0402 277282 (Carl) and 0412 404128 (Tina). Yours faithfully